A somewhat common feature of developing market economies, particularly in South Asia and sub-Saharan Africa, is informality.

Africa’s Informal Sector

From street vendors to house-help to traders in open-air markets to subsistence farmers & fishermen, personal drivers, roadside barbers, small-scale manufacturers, and more, the informal economy accounts for over 70% of total employment in sub-Saharan Africa. Moreover, the sector is said to comprise ~38% of the region’s GDP, more than double the figure for OECD countries.

Like the formal economy in high-income OECD countries and elsewhere, the informal economy includes both self- and wage employment. However, the informal sector is characterized by the lack of regulation and formal contracts. Consequently, this means lack of protection for workers in the event of layoffs or non-payment of wages, absence of social benefits (e.g., pensions, health insurance), and little to no tax revenues generated for or collected by the state.

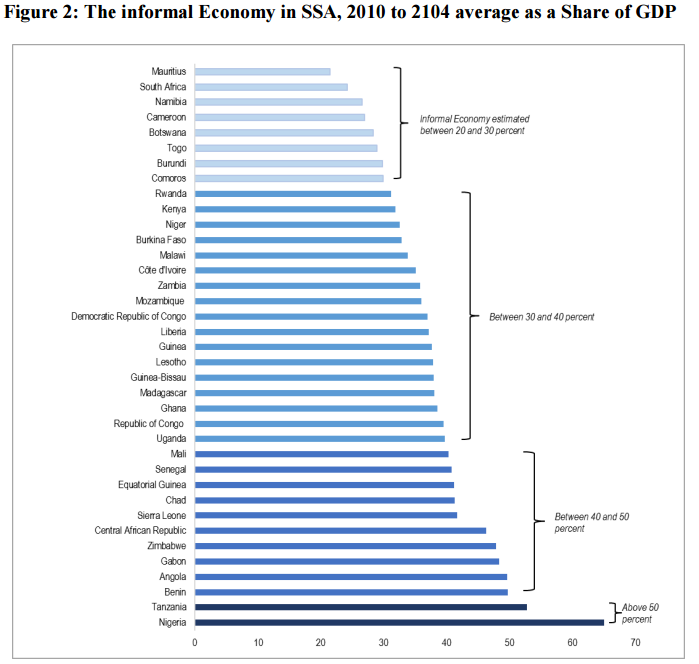

While there are common features prevalent across Africa’s informal economy, its important to note that the size and nature of the sector vary greatly across countries and regions. For example, Senegal’s informal sector is more closely linked to agriculture and forestry than elsewhere on the continent, and the size of informality in Nigeria and Tanzania is much more pronounced than in South Africa and Mauritius.

For a snapshot of current events in the informal sector in sub-Saharan Africa, see The Economist‘s Cracking down on African street vendors.

Generally speaking however, across the continent, the needs of participants in the informal sector remain largely under-served. Coupled with the continuing mobile and digital revolution in the region, this presents fertile ground for entrepreneurs and investors to create & capture value for & from a sizeable market segment with unique needs.

The Role of Street Vendors

Within Africa’s informal economy, one key actor is the street vendor.

Street vending is a vibrant sector of the urban informal economy … Current official statistics indicate that it is most prevalent in sub-Saharan Africa, where in many cities it accounts for 12 to 24 per cent of total urban informal employment.

– Informal Economy Monitoring Study Sector Report: Street Vendors (PDF). WIEGO.

Street vendors in Africa can generally be classified into three loose groups: pure traders (vendors that source goods and sell them at a small markup), value-adders (vendors that transform raw materials into new finished products for sale), and services providers (a broad category that includes roadside barbers, vulcanizers, tailors, and more).

Pure traders primarily have to manage sourcing, transport/commuting, and storage costs, as well as risks of carrying cash, price shocks, and more. Value-adders do much of the same, but also have to think about infrastructure (e.g., electricity) required to transform inputs. And service providers have to further think about specialized training and/or access to capital to purchase and maintain the machinery needed to provide a service.

According to the Deloitte’s 2015 African Powers of Retailing report (PDF), approximately 90% of retail transactions in Africa occur through informal channels. And many of these transactions involve street vendors.

Innovating for Africa’s Informal Economy

While large shares of dollars in developed markets arguably go to digital doohickeys, there remain real opportunities for development (& dividends) for intrepid innovators & investors in Africa’s informal sector. Across the continent, entrepreneurs that pay particular attention to the informal sector are beginning to see results from their efforts at scale. Here are some examples.

Twiga Foods – Innovation in the Farm Produce Ecosystem – Kenya

Kenya’s Twiga Foods, which recently raised a $10.3 million Series A round, developed a unique, mobile-driven solution that addresses some of the challenges faced by participants in Africa’s informal economy, including roadside produce vendors.

Through its B2B mobile commerce platform, Twiga acts as an intermediary between farmers and vendors. Using tuk-tuks (motorized tricycles), it delivers fresh produce to vendors, reducing transportation/commuting costs and minimizing inventory-, cash-related, and pricing- risks. For suppliers, which include small-scale farmers, it offers stable, aggregated demand and minimizes post-harvest losses and price inefficiencies.

Today, Twiga Foods delivers over 4,000 orders a week and has sold over 55 million bananas. Established only in 2014, it is already the largest distributor of a number of basic food staples in Kenya.

Nomanini – Innovation in Informal Sector Payments – South Africa

Despite the growth of fintech and mobile money across Africa, informal vendors are up to 20x as prevalent as mobile money agents. One firm leading the charge in turning these vendors into mobile money agents, in some sense, is South Africa’s Nomanini.

Despite the growth of fintech and mobile money across Africa, informal vendors are up to 20x as prevalent as mobile money agents. One firm leading the charge in turning these vendors into mobile money agents, in some sense, is South Africa’s Nomanini.

Nomanini provides payment solutions focused on the informal retail sector. Its core customer-facing solution is a “business-in-a-box” PoS device which enables informal vendors to distribute digital goods (e.g., airtime and prepaid electricity), and facilitate cash transfers, bill payments, remittances, and other banking transactions. By partnering with Nomanini, informal vendors have seen their monthly income grow by 20-30% or more in some countries.

In addition to enabling micro-entrepreneurship through its bank-in-a-box, Nomanini also offers micro-loans to vendors (based on transactions processed through the device), which provide access to credit & working capital and allow informal vendors to build a formal financial history.

Founded in 2010, over 16 million transactions have since taken place on Nomanini’s platform across the various countries in which it operates (Mozambique, Ghana, Kenya, South Africa, & more), with the vast majority occurring in the last 2.5 years.

Jamii – Innovation in Insurance – Tanzania

As mentioned above, a common feature of informal markets is the absence of social benefits such as health insurance. In Tanzania, where only only 4.5% of the total population has health insurance, Jamii is working to change that.

Jamii provides a mobile micro-health insurance product (accessible via USSD) for the informal sector for as low as ~$1 per month. To offer such rates sustainably, the company studied the cost drivers for health insurance administration and implemented a mobile-driven solution that cut these costs by 95%. It also secured mutually-beneficial partnerships with organizations in key areas.

Specifically, Jamii built a ‘mobile policy management platform’ which carries out the various administration activities of an insurer. The firm goes to market in conjunction with: Jubilee Insurance of Tanzania, leveraging the provider’s network of about 500 health facilities, Vodacom Tanzania, leveraging the telco’s reach & mobile payments platform, and Edgepoint Digital, a sister/parent company specializing in technology.

In large part due to its highly innovative solution for the informal sector, Jamii was selected for the inaugural class of the Barclays Techstars Accelerator in 2016 and has received significant grant funding from the Bill & Melinda Gates Foundation. Earlier this year, the firm closed a US$750,000 seed round reportedly comprised of 50% equity and 50% grant funding.

The Future of Africa’s Informal Economy

The examples of Twiga Foods, Nomanini, & Jamii demonstrate, to some degree, the variety of opportunities for creating and capturing value by innovating for Africa’s vast informal sector. (Notably, all three firms leverage the region’s mobile revolution and increased connectivity, albeit in different ways.)

While there are valuable academic and policy discussions being had and worth having about the future of the informal sector in Africa and globally, innovators, supported by investors, are already shaping it.

If you enjoyed this article, subscribe to be notified when more like it are published.

Share: